7 Simple Techniques For Wyhy

Info about monetary items not offered on Debt Fate is accumulated individually. Our content is precise to the best of our understanding when published.

Indicators on Wyhy You Should Know

That's why we give functions like your Approval Probabilities and cost savings estimates. Of training course, the offers on our system do not represent all financial items around, however our objective is to show you as numerous great choices as we can. Watercrafts can be a lot more pricey than an auto, which indicates funding amounts can be higher and terms can be a lot longer.

Wyhy for Dummies

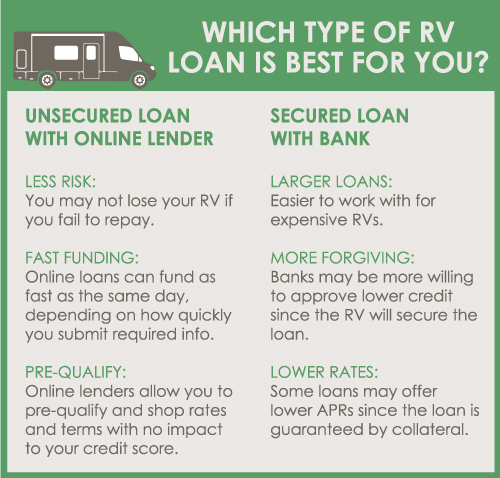

In several states, if you stop paying on your auto loan, the lender can reclaim it. With a secured boat lending the boat acts as the security, which suggests the lending institution might be able to take it back if you go right into default. An unprotected individual financing does not make use of the watercraft or any type of various other asset or residential property as security.

You could have extra alternatives in how you make use of an unprotected boat funding contrasted with a safeguarded boat finance. This type of lending would certainly utilize your home as security for your boat finance.

You can usually obtain up to a 20-year loan term for a protected watercraft lending, depending on the funding amount and lender. Unsafe watercraft car loans which are individual finances tend ahead with much shorter terms (commonly no greater than five to 7 years). The longer your finance term, the much more you'll pay in total interest on the funding.

All about Wyhy

Some lenders offer 0%-down loans yet keep in mind that making a deposit can hedge versus the boat's depreciation, or loss of value with time, and assist protect against a circumstance where you owe much more on your watercraft car loan than the watercraft is worth (wyhy org). A deposit may additionally decrease your regular monthly settlement and minimize the overall quantity of interest you pay on the boat lending

Since April 2023, some lenders provide beginning yearly percent prices, or APRs, of concerning 7% to almost 10% on secured boat financings. Elements such as the watercraft kind and model year, your credit scores history, car loan term and finance quantity will certainly affect your price. If you intend to get a watercraft car loan, you have a variety of loan provider options some financial institutions, credit score unions and boat dealers use watercraft finances.

Not known Details About Wyhy

Below are some financial institutions and cooperative credit union that use boat fundings. Truist, previously SunTrust, offers unprotected marine car loans. The bank's online lending division, LightStream, offers car loans ranging from $5,000 to $100,000, with regards to 24 to 144 months but the loan provider claims you'll need excellent credit for its least expensive rates.

Financial institution personal monitoring or interest-bearing accounts. Financial institution of the West offers lendings for new and previously owned boats and individual boat. The minimum car loan amount is $10,000. Navy Federal Credit score Union offers lendings for brand-new and previously owned boats and personal watercraft, with regards to up to 180 months. Armed forces participants with straight deposit may qualify for a price discount.

The smart Trick of Wyhy That Nobody is Discussing

Some lending institutions will certainly offer a boat loan to debtors with subprime credit history, yet they may still need a deposit and low debt-to-income ratio. Bear in mind that if you have lower credit history, you'll most likely be provided a higher rates of interest than if you have superb credit history. When identifying your watercraft spending plan, do not fail to remember to consider the expenses beyond the monthly repayments for your boat loan.

Then you'll wait on approval, which can be available as soon as the following organization day, or might take a couple of service days, depending upon the loan provider you're working with. Experienced sailors do whatever possible to be prepared on the water so it's excellent to take the exact same approach with a watercraft loan.

Little Known Questions About Wyhy.

Dana Dratch is an individual finance writer (and coffee fanatic). She covers debt, money and way of living problems (credit union casper wy). Read a lot more.

Lenders usually Discover More Here utilize a debt-to-income ratio (DTI) to establish if somebody would certainly get approved for a funding (https://hearthis.at/john-cole/set/wyhy/). That's due to the fact that a candidate could have a healthy income but have a lot of debt, while another person may have a lower earnings yet a lot less financial obligation. It's commonly the proportion that matters to a loan provider

:max_bytes(150000):strip_icc()/payday-loans.asp-final-882c60fabb124a519dada443015c2eb2.png)